LG has quietly shifted its business model: In Korea, LG is now generating 20% of its home appliance sales, including TVs, through subscriptions. Samsung is now following suit , and both companies are expanding this model to other countries. A first step for digital signage, too?

invidis Weekly Exclusive: The Big Bet on Subscriptions

Financing, including leasing, of B2C and B2B hardware is really nothing new. In digital signage projects, external financial service providers also like to convert one-off hardware investments into easier to digest monthly installments — for additional fees, of course.

But what is currently happening with home appliances and consumer electronics in Korea is a different dimension. As The Korea Herald reports, LG Electronics is experiencing enormous growth through subscription services. For small monthly installments, LG offers household appliances on a subscription model, which includes cleaning and performance checks.

In 2023, LG Electronics reached record sales of over 750 million euros from subscription services in South Korea alone. This corresponds to around 20 percent of its total sales in that category and a 31 percent year-on-year growth. It is no wonder that – according to market experts – competitor Samsung Electronics wants to adopt a similar approach in the coming months.

LG started with small household appliances, primarily for seniors, and is now expanding its subscription range to over 300 types of household appliances, from refrigerators to TVs. Much younger target groups are now also being addressed. The obvious success is putting pressure on Samsung to follow suit, as LG is now expanding the subscription business model to other markets in Asia.

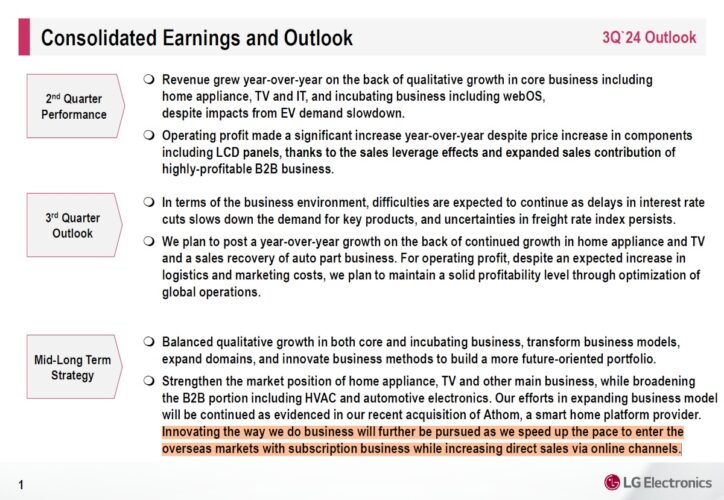

Subscriptions as one of the key factors for LG’s growth

Samsung’s household appliance division saw a 3.6 percent drop in sales in the second half of 2023, while LG saw its household appliance sales increase by 10.6 percent in that same period. Market researchers predict that the market for subscription and rental services for household appliances in Korea will more than double between 2020 and 2025.

Impact on digital signage

The digital signage market in 2024 is far from achieving double-digit growth rates. Contrary to forecasts, demand for digital signage this year remains very low, with no to low growth in most markets. Market players are looking for new opportunities, and subscription models are becoming increasingly popular here, too:

- Almost all digital signage software providers have switched to subscription models in recent years. Not only because of higher company valuations for recurring business models (ARR), but because providers with subscription models can enforce higher prices.

- Hardware manufacturers are also seeking ways to capture a larger share of the value chain by offering additional services, such as content management (e.g., VXT), remote device management, extended warranties, and new global repair services. However, they have yet to find a major strategy that doesn’t overly compete with their partners, like integrators.

- Classic digital signage integrators are facing increased competition from multiple directions. Software providers are reaching out directly to end customers, financially strong visual solution providers are offering global service concepts, and IT integrators bring more experience with managed service solutions.

Now, the major electronics manufacturers — LG and Samsung are just the vanguard — are testing subscription models to revolutionize the B2C market. It would only be a small (logical) step into the B2B world of digital signage & co to introduce signage as a service.

Regardless of when or if a subscription model is adopted, the signs are on the wall: the digital signage market will increasingly shift towards managed services, similar to the B2B IT and consumer electronics markets. Ignoring this development would be naive.