At IFA 2024, MiniLED and OLED will dominate display manufacturers' booths – two technologies that are fighting for supremacy in the premium TV segment.

Premium Display Market: MiniLED Overtakes OLED

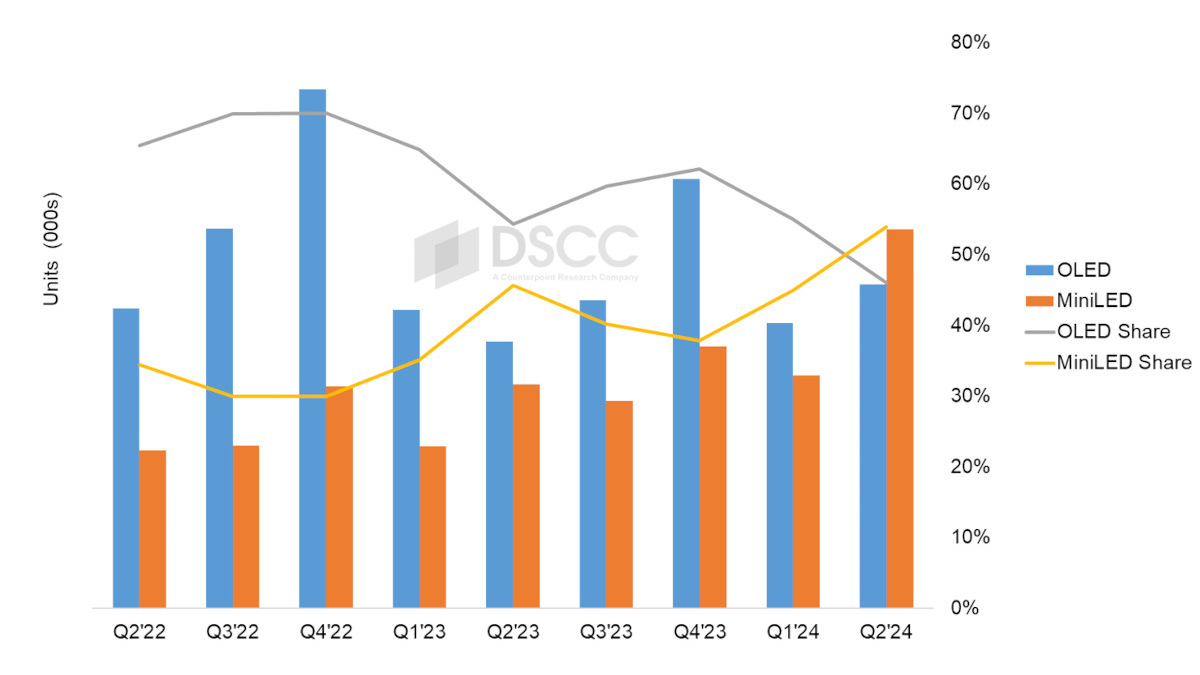

Starting Friday, TV market leaders will once again showcase their latest flagship models at the Berlin consumer tech trade show IFA. For their premium TV offering, most manufacturers are focusing on two emerging technologies: MiniLED and OLED. Although OLED has been dominant for years, MiniLED is gaining ground and, according to a recent DSCC study, achieved the higher sales for the first time in the second quarter of this year. This trend benefits Chinese manufacturers like TCL, who aim to push MiniLED into the consumer market with competitive prices, as will be seen at the upcoming IFA in Berlin.

Advanced TV Report from DSCC

The current “Advanced TV Shipment and Forecast Report” from market research company DSCC shows just how much MiniLED has gained in market share. The report tracks the number and type of advanced TVs sold worldwide each quarter. DSCC defines advanced TVs as those featuring cutting-edge display technologies, including OLED TVs, 8K LCD TVs, and LCDs with quantum dot technology.

In Q2/2024, MiniLED TVs captured over 50% of the market share in the “Super Premium” category, both in units and sales. The TV category was introduced by TCL in 2019. MiniLED TVs use LCD panels with a backlight made up of multiple small LEDs, that can be divided into separately controllable dimming zones. This technology is also the foundation of Samsung’s QLEDs.

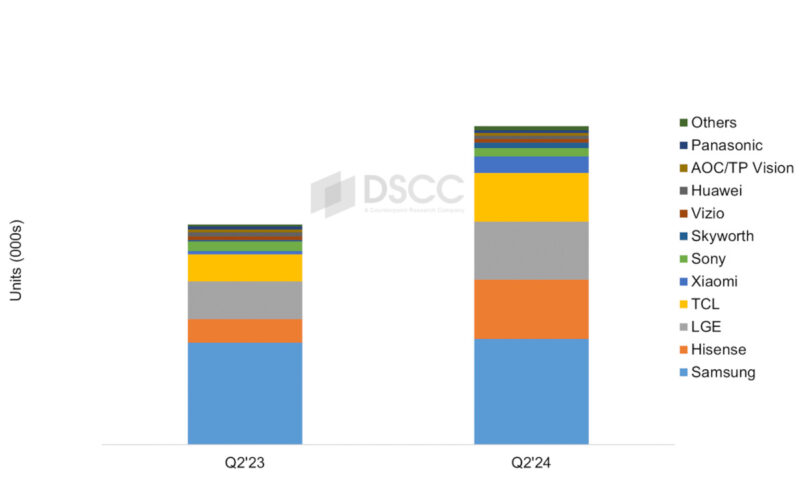

If you include QLEDs in the MiniLED category, Samsung has so far been the market leader in this category – at least since the since the launch of the first QLED in 2021. However, TCL has now regained market share and surpassed Samsung. DSCC notes that this shift is largely driven by increased demand in the Chinese domestic market, but TCL also has its sights set on Europe: Last year, TCL showcased several MiniLED series at IFA specifically for European markets, and plans to expand this offering at IFA 2024.

Competitor Hisense is also aiming to strengthen its presence in the European premium TV segment, but focusing on OLED in addition to MiniLED technologies. For the Berlin trade fair, Hisense has announced a new flagship OLED TV which seems to be designed to compete with LG’s C4. Meanwhile, LG and Samsung, the long-standing market leaders for advanced TVs, have not yet revealed any details about their TV innovations for IFA.

Like the professional display segment, the premium TV segment remains one where manufacturers can still achieve higher margins. However, in both the high-priced B2C market and the B2B segment relevant for digital signage, Chinese manufacturers are capturing more market share with their aggressive pricing. In response, Korean companies Samsung and LG are increasingly focusing on their software business in both their B2C and B2B offering.